Trading within the forex marketplace is sort of a huge sea wherein there are lots of opportunities that one may additionally come upon, however then again it is tough to explore the market if one does not now understand what to do. Price movement buying and selling is one of the effective buying and selling styles that skilled buyers claim to use.

In this particular article, we will speak about the relevance of free action and the way buyers can gain from it to get the most earnings out of the forex marketplace.

Understanding Price Action

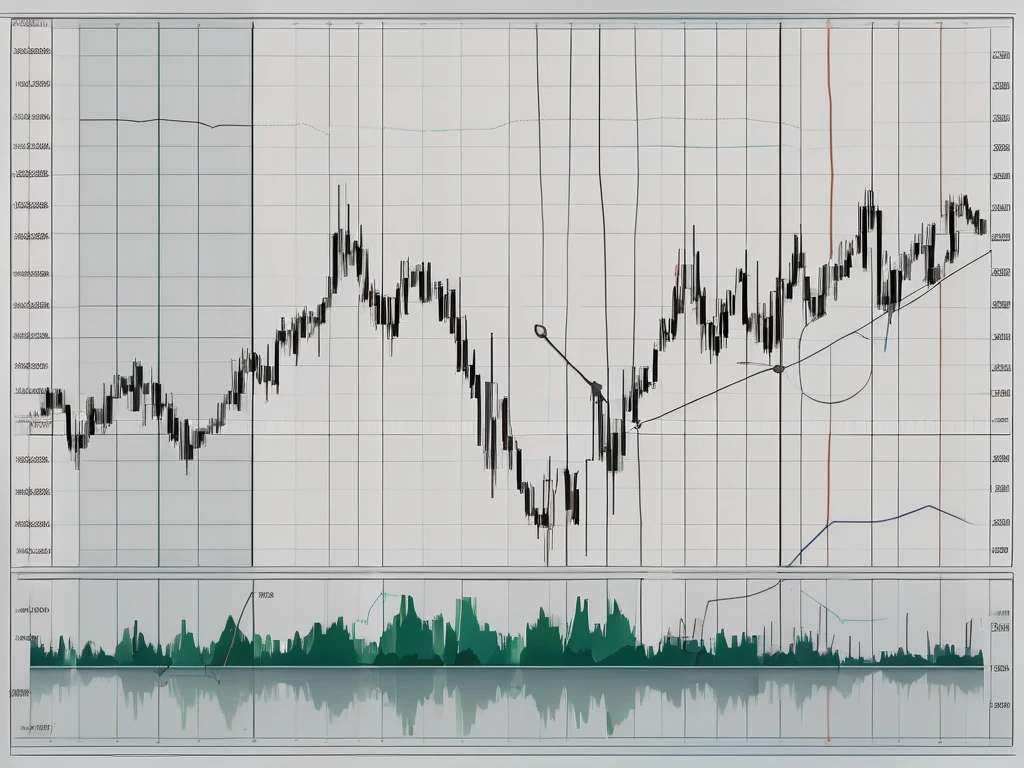

Price action is the depiction of the fee of a safety as it is displayed through the years. For forex traders, it involves the interpretation of charts that constitute expenses of foreign money pairs with the intention of guiding their trading calls.

While other trading strategies should constantly use technical signs to determine the route of the trends, price movement trading does not use any indicators; rather, charge motion buying and selling totally focuses on the actual charge statistics, allowing traders to research market sentiments more as it should be.

Why Price Action Matters

- Simplicity: Another great thing about trading price action is that it is very simple. Both active and passive traders do not have to read multiple indicators or charts. They will have first-hand experience on how to analyze the price movement in order to determine when it is possible to trade.

- Real-time Data: Price action is very up to date since it utilizes current and updated data. The traders can respond to any changes and trends in the market.

- Versatility: It can be used in different markets and time frames which makes it one of the powerful tools that a trader can include in his/her arsenal.

Key Concepts in Price Action Trading

To effectively use price action in forex trading, it’s essential to understand some fundamental concepts:

1. Candlestick Patterns

Candlesticks are the basic chart patterns with regard to price action. They give a visual display in addition to the information they give about the price and can point to possible reversal or further price movement on the market.

Some common candlestick patterns include:

- Doji: A doji is a small pattern that shows indecision inside the market. It occurs whilst the general rate alternate is negligible or identical to the outlet and ultimate prices.

- Engulfing: An engulfing pattern shows a reversal may be possible. A bullish engulfing sample takes place when there is a small white candlestick after a big black one.

- Hammer: A hammer alerts a capability bullish reversal, specially after a downtrend. It’s characterized by a small frame and a long lower wick.

2. Support and Resistance Levels

Price movement buying and selling is especially critical for aid and resistance stages. These stages display the price levels where reversals or consolidations normally arise. It is useful for buyers to realize in which these zones are as it will provide them an idea on wherein to go into the marketplace and whilst to go out.

3. Trendlines

Resistance and aid tiers are plotted to illustrate a fashion line among critical costs of better or decreased stages. They allow a dealer to pinpoint the direction of the trend and viable breakout areas.

Applying Price Action in Forex Trading

With the theory of price action under your belt, now let us look at how you can use the tool to achieve the most profitable forex trades.

Step 1: Analyze the Market Structure

Start by examining the generalized market conditions. Determine the trend current state – whether it is an uptrend, downtrend or a sideways trading (range) market. The first step is critical as it determines your choices for trading.

Step 2: Identify Key Levels

Then, look at your chart and mark out the main support and resistance levels. These levels serve as possible support and resistance levels of entry and exit. Identify key levels with longer time frames and then switch to lower time frames for orders.

Step 3: Look for Price Action Signals

Watch the price move around these points. Use candlesticks or other graphical charts and look for price action patterns that may signify a trading opportunity like trendlines and support and resistance. For example, when the bullish engulfing pattern occurs near the support level, this means that buyers may come in.

Step 4: Confirm with Volume

While price action plays a monumental role in trading, adding volume to your analysis will only make your trading more accurate. Higher volume during a price move usually refers to increased conviction and continuation.

Step 5: Manage Your Risk

Risk management is a very influential concept in trading forex. Have stop-loss orders in place to both limit your losses and to guarantee that you are not leveraged beyond your means. Risk management is another concept including position sizing that is the allocation of a particular amount of capital to each trade.

How to Backtest Price Action Strategies

Backtesting rate motion strategies is an important step in validating their effectiveness before deploying them in a stay trading environment. Here is a step-by-step manual to help you backtest your charge motion strategies:

Choose a Suitable Trading Platform:

- Select a trading platform that offers historical price data and allows you to manually go through past charts. Popular platforms include MetaTrader 4/5, TradingView, and NinjaTrader.

Define Your Strategy:

- Clearly outline the rules of your price action strategy. Specify the entry and exit points, risk management criteria, and the specific price action signals you will use.

Gather Historical Data:

- Obtain historical data for the currency pairs or markets you intend to trade. Ensure that the data spans a substantial period to provide enough information for a thorough backtest.

Set Up Your Charts:

- Configure your charts with the chosen time frames and indicators (if any) that are part of your strategy. For pure price action strategies, focus solely on candlestick charts, support and resistance levels, and trendlines.

Manually Simulate Trades:

- Begin from a point in the past and flow ahead in time, bar with the aid of bar, simulating trades based on your method’s policies. Record every change, which include date, entry and go out fees, stop-loss, take-profit stages, and the end result of the alternate.

Track Your Results:

- Maintain a detailed log of all trades in a spreadsheet. Note the performance metrics like win/loss ratio, average profit/loss, maximum drawdown, and overall profitability.

Analyze the Data:

- Review the logged trades to identify patterns and common conditions under which the strategy performs well or poorly. Look for ways to refine the strategy to improve its outcomes.

Perform Multiple Rounds of Testing:

- Conduct backtesting over different market conditions, such as trending, ranging, and risky markets. This complete method helps determine the robustness and flexibility of your approach.

Adjust and Optimize:

- Modify the method parameters based on the backtest outcomes. Re-take a look at any changes to make certain they enhance the approach’s overall performance without overfitting to historical records.

Keep a Record:

- Document your backtesting technique and outcomes. Recording your findings can serve as a treasured reference and resource in non-stop improvement of your buying and selling method.

By diligently backtesting your price action strategies, you can build confidence in your approach and improve your chances of success in live trading. For more insights and tips on forex trading, be sure to check out other resources like this one and stay ahead of the curve.

Benefits of Price Action Trading

1. Clarity and Focus

Price action trading removes a lot of unnecessary indicators that a trader could be exposed to resulting in over-analysis and excessive thinking about the many indicators, instead of purely concentrating on the price.

This clarity might help in making more confident and accurate trading decisions.s

2. Adaptability

This method may be applied to any buying and selling fashion from natural day-buying and selling to swing trading or even to longer-time period techniques used for inventory making an investment. Regardless of your experience level, it’s viable to apply charge action in strategies that align with private options.

3. Enhanced Market Understanding

Identifying trends on a price chart helps the traders in better understanding of the market as well as psychology. This notion may be crucial, especially when it comes to trading decisions.

Conclusion

Forex trading relies heavily on price action, which is a strong argument. The approach is to analyze the real price data and familiarize themselves with some fundamentals such as candlestick patterns, support and resistance, and trend lines, which enables the trader to gain a substantial advantage in the market. Nonetheless, price action trading is a strategy like any other, and you should practice and be prepared to wait. Charts and patterns should be the first step in learning how to set stop-loss while developing a stronger trading habit.

Are you looking for the latest news, and updates on forex trading?Learn to trade forex with price action and understand the power to gain the maximum potential from this market.

Leave a Reply